In the last few years, Canadian interest rates have made homeownership a bit further out of reach, especially for first-time buyers. Even the slightest changes in rates can significantly affect the amount of home you can afford.

With recent changes in interest rates, understanding their immediate and long-term effects on homebuyers is essential, particularly for young families, downsizers, and other prospective buyers looking to purchase a new home or a quick possession home from a builder.

Immediate Effects of Interest Rate Changes

When interest rates increase, the cost of borrowing goes up, directly affecting monthly mortgage payments.

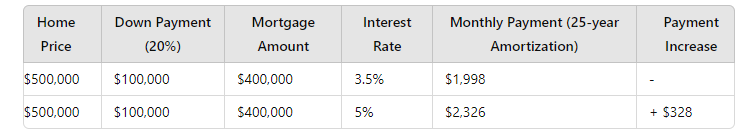

Here’s an example. Consider a home priced at $500,000. With a 20% down payment, you would need a $400,000 mortgage. If the interest rate is 3.5%, your monthly payment over a 25-year amortization period would be approximately $1,998. However, if the interest rate rises to 5%, that same mortgage would now cost about $2,326 per month—an increase of $328.

This increase can significantly affect homebuyers, especially those on a tight budget and variable mortgage holders.

Higher monthly payments mean less disposable income for other expenses, which can strain household finances. For young families in Calgary, this might mean cutting back on activities, delaying renovations, choosing a smaller home than initially planned, or making more money to meet financial goals and obligations.

Interest rates also impact landlords and renters, resulting in rising rent prices that make it more challenging for renters to save for the down payment on their future homes.

Long-Term Effects of Current Interest Rate Trends

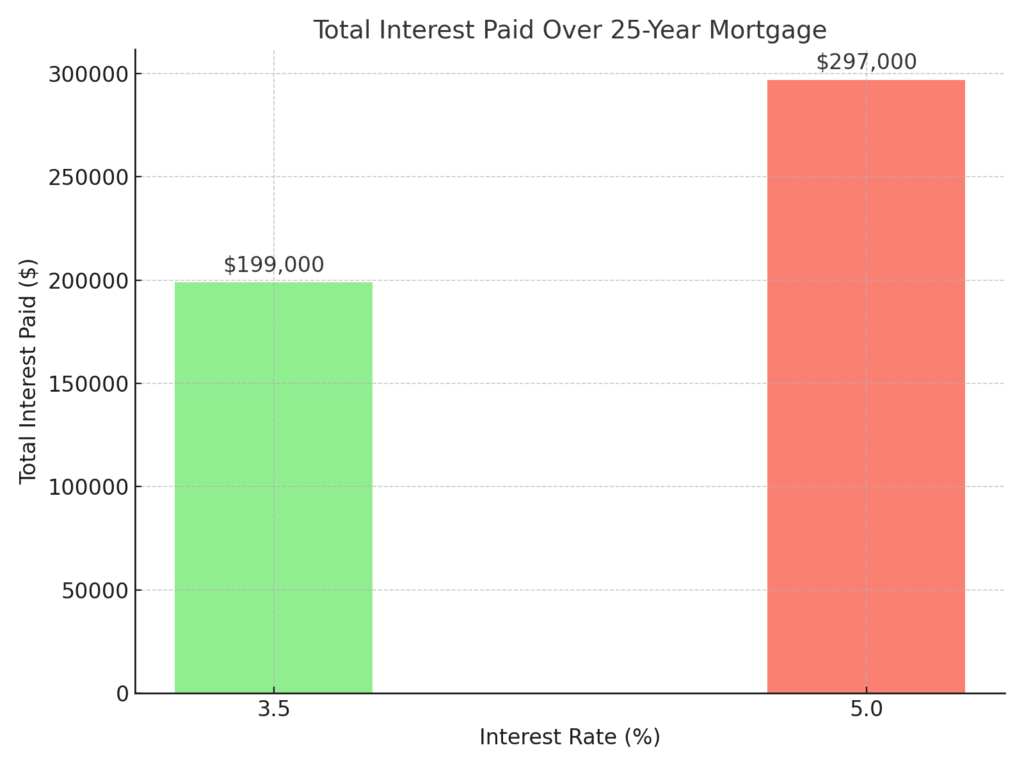

The long-term effects of higher interest rates extend beyond monthly payments. Over the life of a 25-year mortgage, the total interest paid on a $400,000 loan at 3.5% would be around $199,000. At 5%, the total interest paid jumps to approximately $297,000—nearly $100,000 more.

This difference illustrates the importance of securing a mortgage at the lowest possible rate to reduce long-term financial burdens.

With rates possibly remaining elevated, home prices may stagnate or even decrease in some areas as fewer buyers can afford to enter the housing market.

For example, in Calgary, where the market has seen fluctuations, a sustained period of higher interest rates could lead to reduced demand, stabilizing or lowering home prices. However, this scenario could also make it harder for sellers, particularly downsizers, to get the desired price for their homes.

Impact on Different Homebuyer Groups

Young Families

Young families often seek homes that accommodate their growing needs, such as additional bedrooms or proximity to schools. Higher interest rates may force them to reconsider their options, potentially leading to compromises on location or home size.

The impact is even more pronounced in Calgary, where the average home price is relatively high compared to other parts of Canada. Young families might have to look at more affordable suburbs or delay their purchase until rates drop.

Downsizers

Higher rates can be a double-edged sword for those looking to downsize. While they might get a better deal on a smaller home, selling their current home could be challenging in a market with fewer buyers. Downsizers in Calgary might need to adjust their expectations or wait until the market becomes more favorable before selling.

First-Time Buyers

First-time buyers are susceptible to interest rate changes. Even a slight rate increase can significantly affect their ability to qualify for a mortgage. With Calgary’s housing market already competitive, higher rates could push some first-time buyers out of the market, forcing them to continue renting or seek more affordable options in less desirable locations.

Broader Implications for the Housing Market

These trends are echoed across Canada. Cities like Vancouver and Toronto, where housing prices are even higher, are acutely impacted by interest rate changes. However, Calgary’s relatively lower prices offer some relief, making it a more attractive option for those priced out of other markets.

As interest rates evolve, potential homebuyers need to stay informed and flexible. Those considering a purchase should evaluate their long-term financial stability and explore options like rate locks or shorter mortgage terms to mitigate the effects of rising rates. You can’t time the market, but staying aware of interest rate changes can help you buy a new home at the right time for you and your family.

Benefits of Choosing a New Home or Quick Possession Home from a Builder

Choosing a brand new home from a builder can offer many benefits to new buyers in an expensive market.

Communities in the surrounding areas of Calgary, like Chestermere, Cochrane, and Airdrie, are often a bit more affordable than homes in the inner city. Builder home prices are also transparent, and you don’t need to negotiate prices, ensuring you can choose a beautiful home you know will fit your budget.

A new home offers the added benefit of having warranties, and as every component is brand new, it tends to be issue-free for many years. Families also don’t need to worry about renovations and upgrades for many years.

New Homes in Calgary and Surrounding Areas

In the current market, interest rates are more influential than ever. Understanding their impact on your mortgage can help you make better, more informed decisions and potentially save money in the long run. Whether you’re a young family, a downsizer, or a first-time buyer in Calgary, staying informed and planning accordingly can help you navigate these challenging times.

At Douglas Homes, we create homes that embody quality, value, and pride. With over 35 years of experience and a commitment to excellence, we’ve helped countless families find their dream homes without compromising on craftsmanship or budget. Whether you’re a first-time buyer, a growing family, or are looking to downsize, we have the perfect new or quick possession home for you. Explore one of our incredible communities and learn that remarkable is within reach.